By Karl Strom, editor

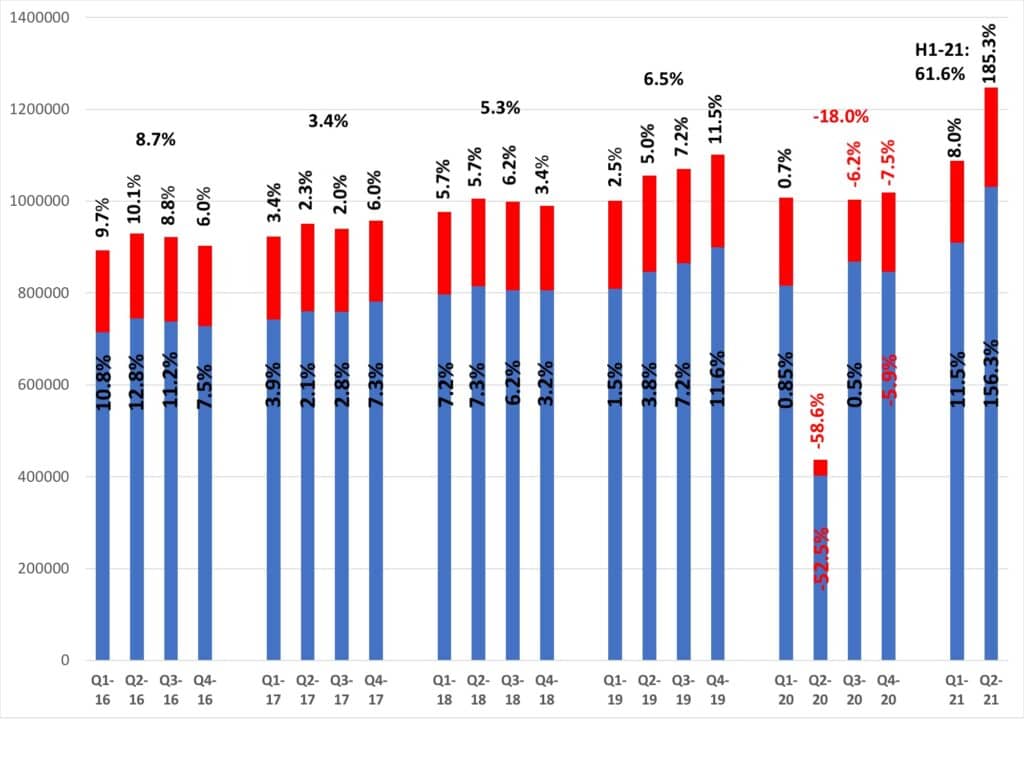

Even though any comparison of today’s US hearing aid sales to those of 2020 is bound to include gaudy numbers—recall that total sales fell by more than half (58.6%) in the second quarter of last year due to the pandemic—the latest statistics from the Hearing Industries Association (HIA) indicate a big comeback in 2021 for hearing aid dispensing. For the first half of 2021, net unit sales rose by 61.6% when compared to 2020, and by 13.5% when compared to the pre-pandemic period of H1 2019.

Returning to last year, total year-end US net unit sales in 2020 were 18.0% below those of 2019 due to Covid-19 and the reluctance of older adults to visit hearing care offices and risk exposure to the virus (Figure 1). Private-practice and commercial market dispensing decreased in unit volume by -14.2% and by -34.0% at the VA.

Things are decidedly brighter today. Total hearing aid sales increased by 8.0% in the first quarter of 2021, followed by a 185.3% increase in the second quarter (against the 58.6% decrease in Q2 2020) as inoculation rates of US adults ages 65+ have now reached 80% (completed doses, July 27). When comparing this year’s statistics to those in pre-pandemic 2019, net unit hearing aid sales rose by 8.7% and 18.2% for Q1 and Q2 2021, respectively (Table 1). In other words, it would currently appear that pent-up demand may make the 2020 pandemic a “blip”—albeit a very painful and memorable blip— in the historical progress of hearing aid adoption and market growth.

Private/Commercial dispensing. Hearing aid sales at private-practice and commercial (including mass merchandisers) businesses were more resilient than the dispensing activity of the US Department of Veterans Affairs (VA), both during and as we emerge from the effects of the pandemic. Hearing aid sales in the commercial market rose by 11.5% and 156.3% in the first two quarters of 2021 compared to last year, respectively. (As shown in Figure 1, hearing aid sales in the first quarter of last year were actually positive at 0.7% due to a strong January and February.) When compared to 2019 Q1-Q2 , hearing aid sales were 12.4% and 21.8% higher, respectively.

VA dispensing. Because of its unique patient population and other factors, the VA has been slower to recover from an almost-complete shutdown of dispensing activity during the second quarter of last year (-83.4% decrease vs Q2 2019), followed by decreases of -34.5% and -14.7 in Q3 and Q4 of 2020, respectively. Hearing aid dispensing continued to improve in the first quarter with a -7.1% decrease compared to 2020, then shot up by 522.1% in the second quarter—even surpassing VA sales from the pre-pandemic levels of 2019 by 3.3%.

What might be ahead? The bottom line is that 2021 is shaping up as an excellent recovery year, with much of the speculation about possible “pent-up demand” being vindicated. When comparing first-halves, total US net unit hearing aid sales in 2021 are 13.5% above 2019 pre-pandemic sales, with the commercial market increasing by 17% and the VA with a shortfall of -1.7%.

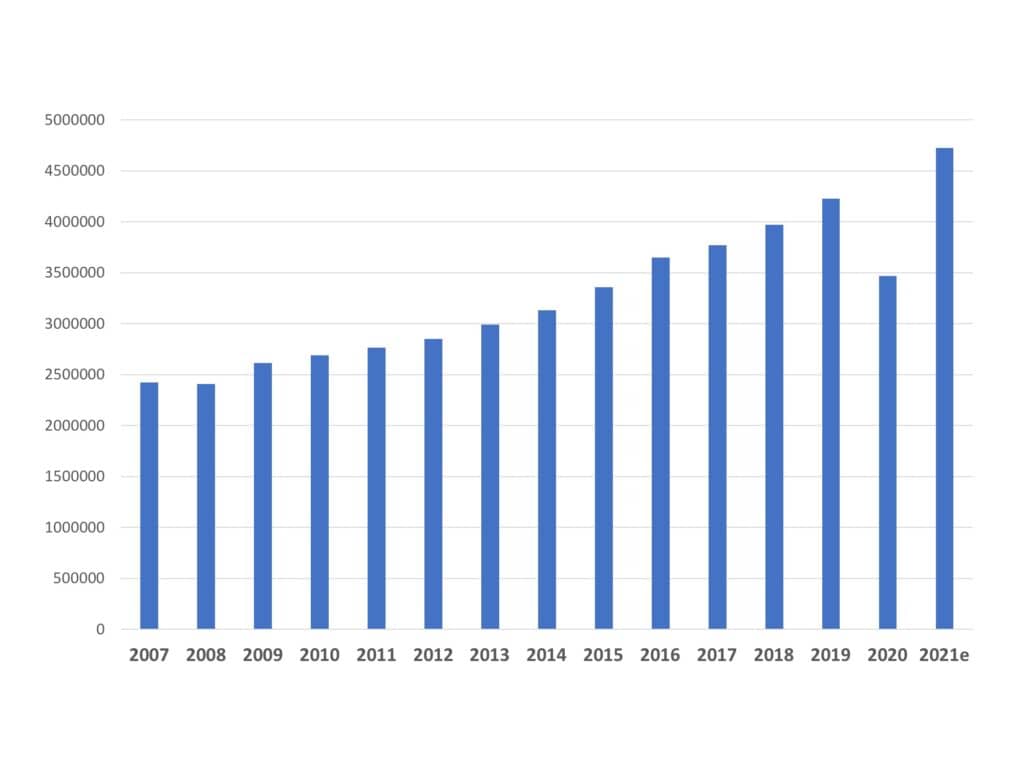

Should hearing aid sales continue at a pace around 10% above 2019 levels, year-end hearing aid unit volume would approach or exceed 4.7 million units—representing a 36% increase over last year and a 12% increase over 2019 (Figure 2). Of course, this all depends on our continued thwarting of the coronavirus and emergence from the recession it produced, and the potential threats and opportunities of the upcoming FDA regulations on over-the-counter (OTC) hearing aids, among other possible factors. Another large factor: how much pent-up demand for hearing aids might there be? Right now, the engine of the hearing healthcare market is starting to hit on all its cylinders.

About the author: Karl Strom is editor of The Hearing Review and has been reporting on hearing healthcare issues for over 25 years.

Also see:

US Hearing Aid Sales Fall by 59% in Second Quarter 2020

US Hearing Aid Sales Rebound Strongly in Third Quarter 2020

US Hearing Aid Sales Fall by 18% in 2020

Image: © Dilok Klaisataporn | Dreamstime