Correction: An earlier version of this article incorrectly stated that Intricon was divesting its Hearing Help Express business. Although the transcript of the investor meeting suggests that is the case, a spokesperson for Intricon says they are only scaling back and not divesting their interests in Hearing Help Express. The Hearing Review apologizes for the error.

IntriCon Corporation, Arden Hills, Minn—a designer, developer and manufacturer of miniature interventional, implantable and body-worn medical devices, including hearing aids and amplification device technologies—announced on May 19 that it has completed the acquisition of privately held Emerald Medical Services (EMS) Pte Ltd, Singapore, and will scale back its Hearing Help Express operations in DeKalb, Ill. According to Intricon, this latest acquisition expands the company’s medical coil and micro-miniature medical device engineering and manufacturing capabilities in surgical navigation, and accelerates diversification into potential new end markets. During the same conference call, Intricon President and CEO Mark Gorder stated the company is reprioritizing its investments to more clearly focus on securing high-profile partners that value Intricon’s ability to deliver an ecosystem of care platform, which includes hearing aids, self-fitting software, and customer care to the US market.

Intricon (INN) is a NASDAQ-listed company that supplies many branded hearing aids and owns the online distributor Hearing Help Express; however, much of its business is devoted to supplying microelectronics to key customers like Medtronics. Until late last year, the company had also supplied UnitedHealthcare’s Hi HealthInnovations hearing aid until the insurance giant decided to pivot towards a more traditional “brick-and-mortar” approach in the second half of 2019. It is known that Intricon has been courting several large players who will be involved in the future OTC hearing aid market, once the FDA finalizes regulations for that device category (possibly now as late as the second quarter of 2021 due to FDA being consumed with the Covid-19 pandemic). Gorder said Intricon will continue to engage in discussions with commercial entities that are actively pursuing end-consumer healthcare initiatives, including retailers, branding partners, and pharmacies. He said Intricon will now focus its remaining DTC operations at Hearing Help Express to solely support partnership initiatives. The company anticipates incurring a $1.2-1.5 million charge in the second quarter for severance, lease termination, and other operations-related expenses, said Gorder. Intricon is developing a self-fitting ecosystem for OTC corporate partners that is anticipated to be available by Q2 2021.

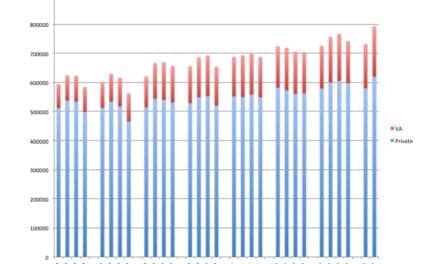

In the investor conference call, Intricon Executive VP and CFO/COO Scott Longvall reported that total revenue for Intricon’s Hearing Health segment during the first quarter was $3.9 million, down 45% compared the first quarter of 2019, reflecting the termination of the hi HealthInnovations contract and Covid-19’s impact on the distribution channel. Within Intricon’s Hearing Health division, indirect to end consumer revenue was $744,000, direct to end-consumer revenue through Hearing Help Express business was $1.2 million, and legacy OEM revenue was $2 million.

Their latest acquisition, Emerald Medical Services, provides joint engineering and manufacturing services for complex medical devices, including catheters covering a range of applications for cardiology, peripheral vascular, neurology, radiology and pulmonology. EMS’s production capability consists of design, development, manufacturing, testing and non-sterile packaging services. The company is located at the same site at Intricon’s Singapore manufacturing facility, and it had 2019 revenues that were approximately $7.5 million with a compound annual growth rate from 2016 through 2019 of 34%, according to the recent corporate conference call.

Under the terms agreement, Intricon will make an upfront payment of approximately $7.1 million, 80,000 shares of IntriCon common stock, and a cash earnout based on the achievement of specific sales milestones over a 3-year period.

“As we sought opportunities to build on our core competencies as a miniature and micro-miniature device manufacturer, Emerald Medical Services stood out as an ideal strategic complement to our business,” said Gorder i a press release. “We have been familiar with their high-quality design, development and manufacturing services in the complex catheter space for some time. In addition, EMS’s existing technology expands our addressable market within surgical navigation and diversifies our customer base. This transaction combines two business that are dedicated to developing and manufacturing devices that support the advancement of medical technology.”

As with most companies in the hearing healthcare segment, Intricon has furloughed some employees to help reduce expenses during the Covid-19 pandemic. Gorder said the company has completed a global net workforce reduction of approximately 25 administrative and support employees, partially offset by a few key hires. Intricon anticipates the net effect of these actions to further reduce operating expense by approximately $1.5 million.