Hearing Aids | April 2023 Hearing Review

Overall, U.S. hearing aid sales were up by about 1%, while commercial units fell by 0.6% and VA units increased by 7%.

By Karl Strom

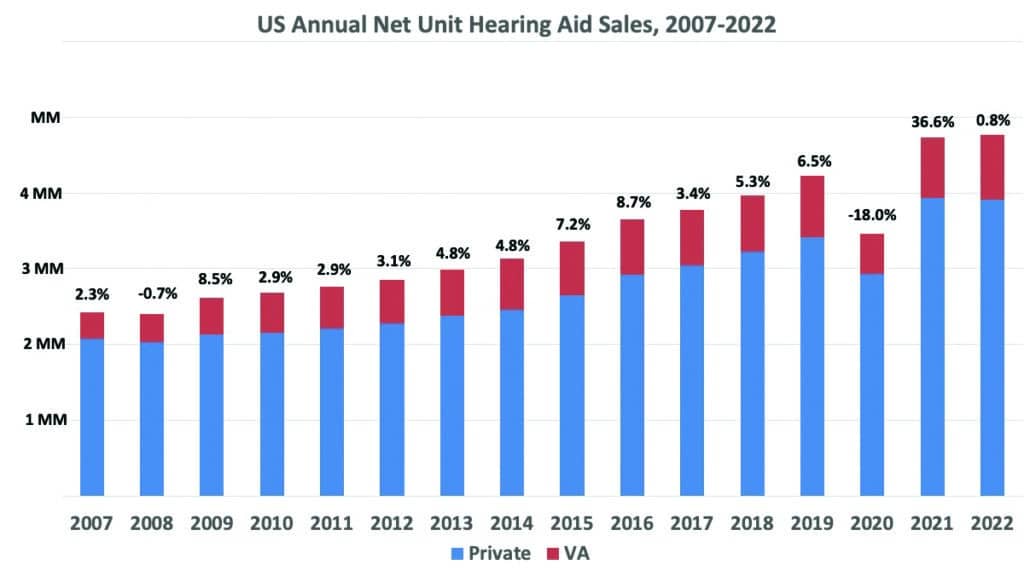

In 2022, U.S. hearing aid sales increased nominally by 0.8% to 4.77 million units, compared to the post-pandemic year of 2021, when pent-up demand caused sales to surge by 37% (Figure 1). When looking at both the commercial and VA markets, about 36,000 more hearing aids were sold in 2022 compared to 2021, with 22,000 fewer units sold in private practices and the commercial sector and 58,000 more units in the U.S. Department of Veterans Affairs, according to statistic generated by the Hearing Industries Association (HIA), Washington, DC.

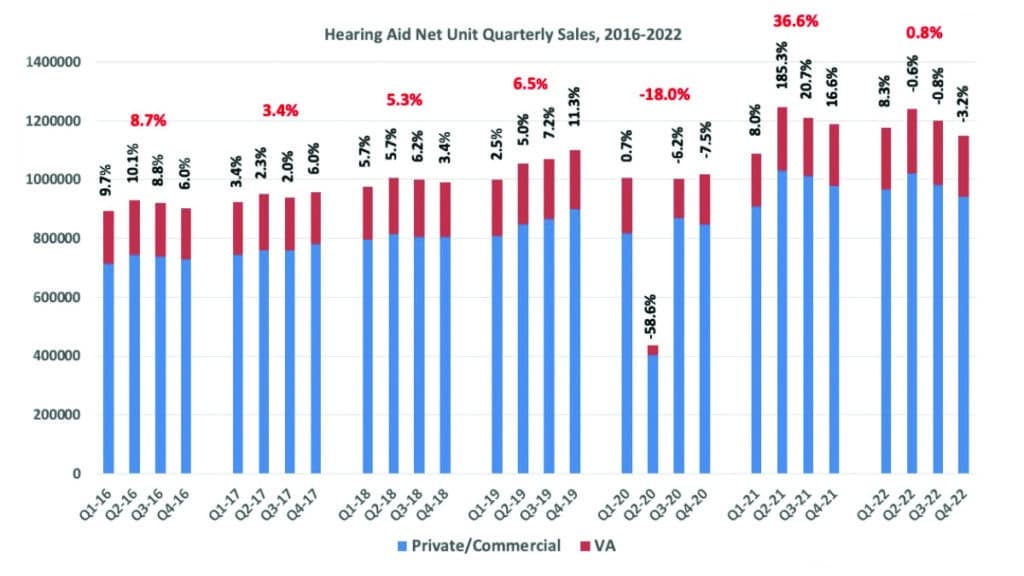

Given the very strong comparison base from 2021 and significant macroeconomic headwinds, the U.S. hearing aid market in 2022 was still relatively resilient (Figure 2): strong net unit sales in the first quarter (Q1, an 8.3% increase) were followed by progressively worse sales in Q2-Q4 compared to the same periods in 2021 (-0.6% to -3.2% decreases).

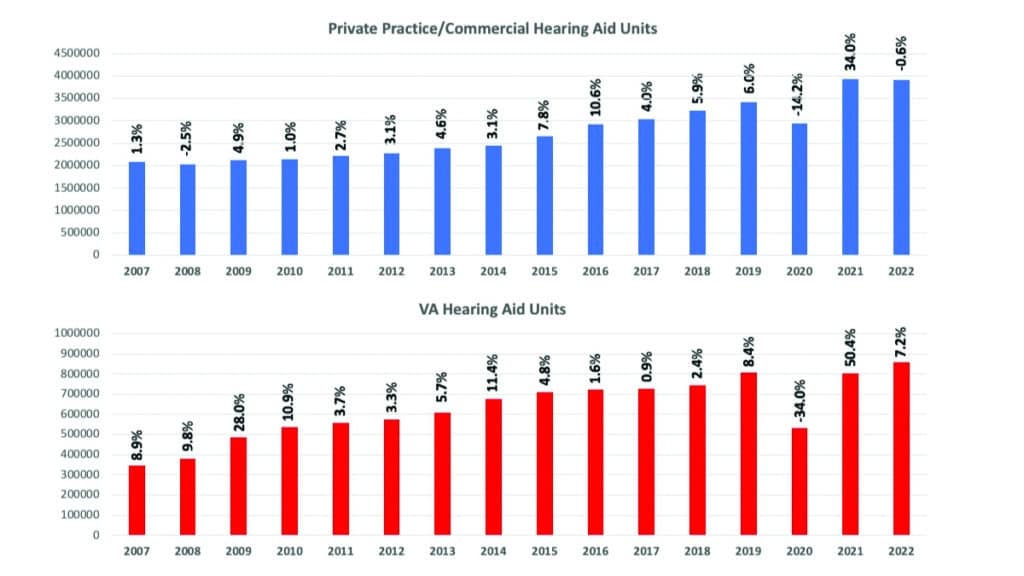

Net commercial sales of hearing aids—including those of private practices and mass merchandisers—decreased modestly by -0.6% in 2022, following a substantial 36.6% increase in 2021. Commercial unit sales were up by 6.3% in Q1 but then fell progressively by -1.0%, -3.2%, and -3.7% in the last three quarters, compared to the same periods in 2021. The last time we saw three consecutive quarters of negative commercial unit sales was almost 15 years ago during the 2008 stock and housing market meltdown.

Net units dispensed by the VA and other government agencies during 2022 increased by 7.2%, after a 50.4% increase in 2021 (Figure 2). The VA saw unit increases of 18.5%, 1.5%, and 11.6% in the first three quarters, but dipped into slightly negative territory (-0.81%) in Q4.

When viewed next to each other, both the commercial and VA markets have experienced steady growth during the past 15 years (2008-2022), with average sales increases of 4.7% and 7.6%, respectively (Figure 3). The total average U.S. annual percentage growth rate is 5.1% during that same period.

Key influencing factors in 2022-23 for hearing aids sales

In last year’s market analysis, I predicted higher-than-average hearing aid sales (>5%) for 2022 “barring an uptick in Covid-19, stock market upheaval, recession, military conflicts with Russia or China, political turmoil during the mid-term elections, or some other unforeseen adverse event.” As noted above, U.S. unit sales were relatively flat with a -0.6% decline in the commercial market and a 7.2% increase for the VA, for a 0.8% overall increase.

Although not fitting the technical definition of a recession, 2022 brought terrible economic news especially for seniors who rely on fixed income sources and returns from retirement funds. The S&P 500 finished down by 19.4%, the Russell 2000 dropped by 33.1%, and 2022 was the worst-ever year for holding bonds. Added to that was a 9.1% inflation rate, a level not seen since the Reagan years, and rising interest rates.

Although the coronavirus restrictions for the general population were lifted by the first quarter, an outbreak in China affected the worldwide economy, as did the war in Ukraine. In short, there were plenty of reasons for seniors and other potential hearing aid buyers to sit on their wallets.

But, given all this, hearing aid sales were pretty resilient. I’ve argued before that the hearing aid market has a history of doing okay during recessions and economic downturns. It’s not recession-proof, but it is recession-resistant. It appears this trait held true for 2022 as well.

Six things to watch in 2023

The major hearing aid manufacturers appear to be relatively bearish about what 2023 will bring, with predictions of the global market increasing by 1-3% in unit volume and average sales prices (ASPs) slipping by 1-2%. Much of it will hinge, of course, on the economy—particularly inflation’s effect on seniors—as well as the continuing war in Europe and the associated macroeconomic and geopolitical hardships and risks it brings.

Concentrating on the hearing healthcare industry, there are at least six other items that will probably continue to make headlines during 2023:

1. VA hearing aid sales. The second largest dispenser of hearing aids in the world after England’s National Health System (NHS), the VA constituted 18% of all U.S. hearing aids dispensed in 2022. As noted in my 2021 year-end market analysis, VA dispensing activity had a long way to come back from its near-dead stop during the pandemic. In the middle of 2020, it saw a -83.4% and -34.5% decrease in units dispensed, then was slow to recover as different regions of the country experienced new waves of the coronavirus. For example, the HIA statistics show the VA dispensed about 6,000 fewer hearing aids in 2021 than in 2019, while the private sector dispensed over 511,000 more. So, putting this into perspective, the VA’s overall 7.2% unit increase in 2022 may have been on the low side of what some expected. In my view, there is still room for strong VA dispensing activity in 2023, and private practice hearing care professionals working with the VA may benefit.

2. Costco sales. Accounting for somewhere around 14% of all U.S. hearing aid sales, Costco creates ripples in the market with anything it does. So, it was big news in October when Hearing Tracker reported that Costco’s Kirkland Signature (KS10) flagship hearing aid made by Sonova had been discontinued, followed by a November announcement from Sonova that its Phonak products would no longer be available at Costco. The mass retailer also discounted some of its hearing aids by around $200 in the latter part of the year. Currently, there is no word about Costco announcing a new KS11 hearing aid, and it may simply stick with offering branded hearing aids from Philips (Demant), Jabra (GN), and Rexton (WSA). Whatever the case, Costco has made some major changes in 2022 and more could be in store for 2023.

3. Growth of insurance coverage for hearing aids. In 2022, there was continued growth of hearing aid benefits from managed care, insurance carriers, and Medicaid. There is no reason to think this trend will not continue. It’s also worth noting that hearing aid coverage was among the last items left standing in the $1.9 trillion Build Back Better omnibus bill. Although this legislation did not pass, you can be certain there will be future legislative proposals for Medicare coverage of hearing aids.

4. OTC hearing aids. Did OTC hearing aids impact sales of professionally dispensed hearing aids? Although statistics were unavailable for this article, HIA has started collecting OTC hearing aid sales data from its member companies. By most reports, these sales were small in Q4 2022 among HIA members. However, conversations with OTC and direct-to-consumer (DTC) hearing aid distributors suggest a significant sales upturn on October 17, with one company characterizing it as a “break-out” quarter. The HIA statistics reported here say little about how OTC sales affect the traditional hearing aid market, except that they certainly are not taking the industry by storm or causing any notable cannibalization of traditional hearing aid sales. The caveat, of course, is that the marketing of true OTC hearing aids only began in mid-October. However, the prevailing opinion among industry experts is that prescriptive and OTC hearing aids are each aimed at two distinct markets—with the latter composed of younger people with milder situational hearing-losses—and consumer interest in OTC hearing devices will ultimately spark growth in both markets.

5. More industry consolidation? There is the possibility for a Demant-GN Store Nord merger/acquisition in 2023, as GN Store Nord has found itself overleveraged after its $1.24 billion purchase of e-gaming giant SteelSeries. One scenario is that GN could split up its hearing and audio divisions; another is that the highly profitable company issues more shares and things remain as they are. The William Demant Foundation, which owns Oticon and controls over 10% of GN’s shares, is the most apparent M&A candidate—leading to a lot of speculation by market analysts. However, whether the companies’ boards and shareholders, as well as the applicable regulatory agencies, would approve such a sale is far from certain.

6. More published science on why hearing healthcare is vital to mental and general healthcare. This much is certain: More detailed information about how better hearing contributes to quality of life, cognitive function, reduced isolation and loneliness, and better overall health status will emerge in 2023. In particular, the ACHIEVE study results, which Johns Hopkins is coordinating, are expected to be published within the next couple of weeks.

With some exciting new products being launched this spring, increasing links between hearing health and cognition, and the new OTC hearing aid market, sales of hearing aids should continue to grow at their 4-6% rate well into the future. What’s in store for 2023? A 5% increase in 2023 sales would push U.S. hearing aid unit sales over the 5-million-unit mark for the first time ever. Although the year’s first half may start slow, this “industry first” is still a possibility.