Updated April 22, 2020

Covid-19 Survey #2 | May 2020 Hearing Review

To get a PDF of this report, click here.

Effects of the coronavirus pandemic on audiologist and hearing aid specialist practices

By Karl E. Strom, editor

Hearing healthcare offices are not wasting time being beleaguered over the disturbing loss in appointments, gross revenues, and the challenging business climate due to the Covid-19 pandemic; they’re preparing for the future and hoping to emerge stronger, more resilient, and in a better position to take advantage of the major trends that have been sweeping hearing healthcare. This is borne by the fact that only 8% of dispensing professionals who responded to this latest survey said they were not working on anything involving their businesses or professional advancement.

So, the boiled-down game-plan: first survive, and then thrive.

Hearing Review initially surveyed hearing care professionals (HCPs) about the Covid-19 pandemic’s effects on their practices from March 19-24, 2020—one of the first weeks of the outbreak in the United States and Canada—when widespread school and business closures and CDC recommendations for social distancing just started.1 Because the industry was in such a state of flux, the HR Covid-19 Survey #1 ended up being more of a snapshot within a rapidly deteriorating business time-frame.

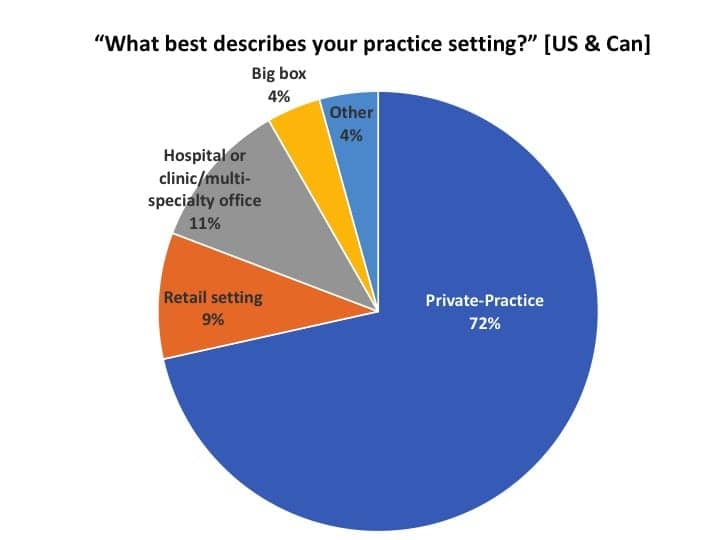

The present survey, conducted between April 9-17, shows a still-shifting business landscape, but the 326 professionals who filled out the survey had fairly uniform responses over this 9-day period. In analyzing the data, HR removed 15 respondents who did not dispense hearing aids, leaving a total of 311. Of those, 91% were from the United States, 6% from Canada, and 3% from outside North America. When looking at respondents from only the US and Canada (Figure 1), more than 4-in-5 were working in either a private practice (72%) or a retail office (9%); 11% in hospitals, clinics or multi-specialty settings; 4% in big box or mass merchandiser outlets, and 4% in various other settings (eg, university clinics, non-profits, etc).

Editor’s note: Because the Covid-19 pandemic appears to have hit private practice and retail (PP&R) offices disproportionately hard—and these offices constitute 81% of this survey’s respondents (and HR’s core readership)—I will focus primarily on this segment. In almost all cases, except where noted, the statistics for the total dispensing professionals (ie, including hospitals/clinics, big box, etc) were generally within 5% of those of PP&R offices. Readers interested in the “all dispenser” figures may contact the editor for more detailed data.

Business Survival During the Covid-19 Crisis

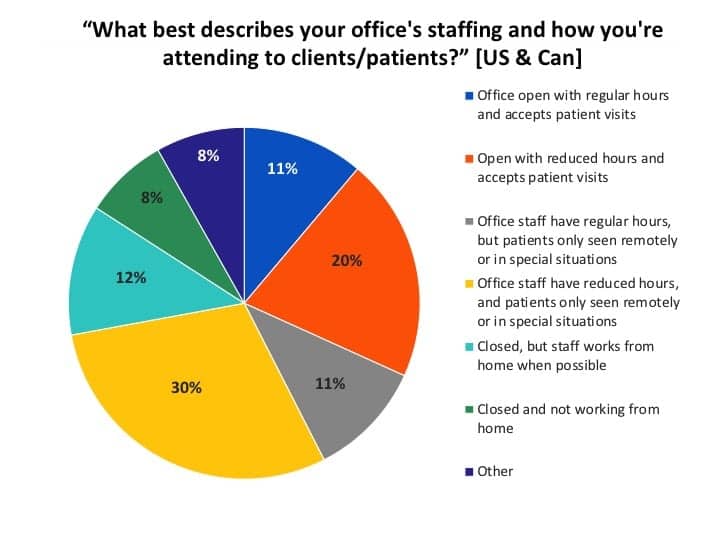

Office staffing and patient visits. Figure 2 shows answers to the question, “What best describes your office’s staffing and how you’re attending to clients/patients?” Nearly one-third (31%) of US respondents working in private-practice or retail (PP&R) settings were physically seeing patients in their practices during regular (11%) or reduced (20%) office hours. A larger percentage (41%) were not accepting patient visits except for special situations, but were still observing regular (11%) or reduced (30%) office hours. A total of 12% were closed but the staff worked from home when possible, and 8% were closed and not working from home. Another 8% had “other” responses, such as switching or trading off tasks with staff member(s), only the owner and/or receptionist working in the office, etc.

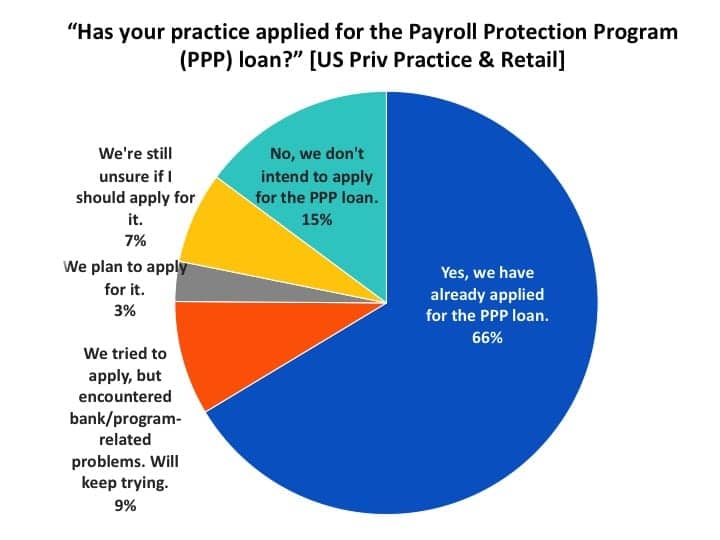

PPP and EIDL loans. A current nail-biter for many US small businesses has been the status of their Paycheck Protection Program (PPP) loan, which is designed to help companies maintain their payrolls and keep them running during the coronavirus crisis for an 8-week period through June 2020. The loan is forgivable if certain criteria are met. Unfortunately, the PPP program predictably ran out of money about a week after it was introduced on Friday, April 3—after the program’s details were presented to banks just the evening before.2,3

Figure 3 shows that more than three-quarters (78%) of US PP&R respondents expressed interest in receiving a PPP loan: two-thirds (66%) indicated they had already applied for the loan, while another 9% had tried to apply, but encountered bank or program-related problems (and would keep trying), and 3% were still planning on applying. A total of 15% said they were not interested in the loan, while 7% were still unsure.

When looking at total US survey responses (ie, including hospitals, big box, etc), 57% had already applied for the PPP loan, while 24% did not intend to do so.

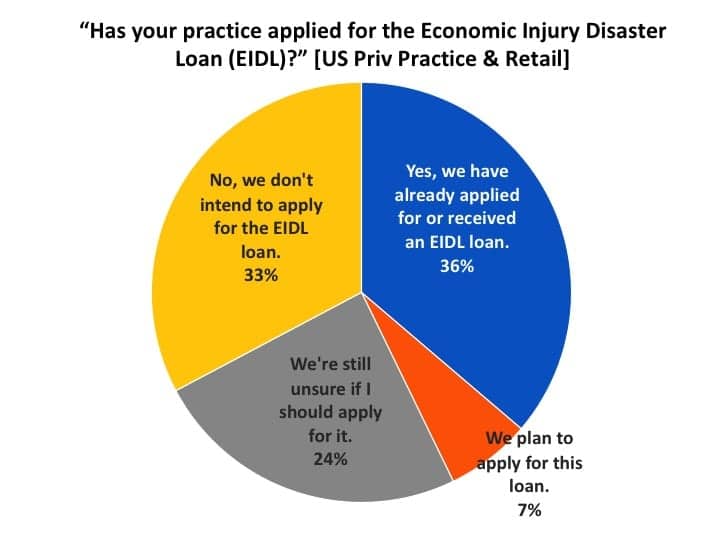

By comparison, only about half as many US practices had applied or were interested in the Economic Injury Disaster Loan (EIDL), with many being unsure if they should apply for it. The EIDL is a grant up to $10,000, and it works more like an advance that, in cases, does not require repayment (see program details). Like the PPP loan, this fund was also quickly depleted, and Congress is proposing more money for the program at this writing. Figure 4 shows more than one-third (36%) of US PP&R dispensing offices applied for or received the EIDL loan, and another 7% planned to apply for it. A fairly larger proportion (24%, compared to 3% for the PPP loan) were still unsure whether they should apply for it, while one-third (33%) did not intend to apply for the loan.

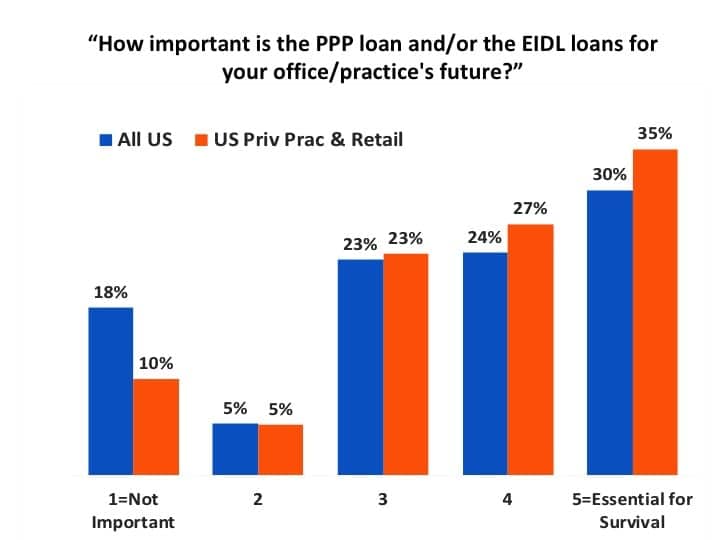

The PPP and EIDL loans appear to be extremely important for our industry, particularly when it comes to private practices and retail offices (Figure 5). When asked to rate the importance of the loan, more than one-third (35%) of PP&R respondents said it was essential for the survival of their businesses, compared to 30% for all US practices (ie, total US survey responses including hospitals, big box, etc). When taken together, 77% of all dispensers gave it a 3-5 rating in terms of importance—with 85% of PP&R dispensers rating it as important to essential for survival.

As this article was being published, new funding from Congress was expected to include another $300 billion for the PPP program, and $50 billion for the EIDL. But “Round 2” could go even faster—or almost instantly—for these loans.4 In the first round, the SBA approved 1.6 million PPP loans, with hundreds of thousands of applications still in limbo (there are 30.2 million small businesses in the US, although certainly not all could apply for these loans). Some estimates show that $400 billion in EIDL loans have already been requested, but the program was originally funded for $10 billion.

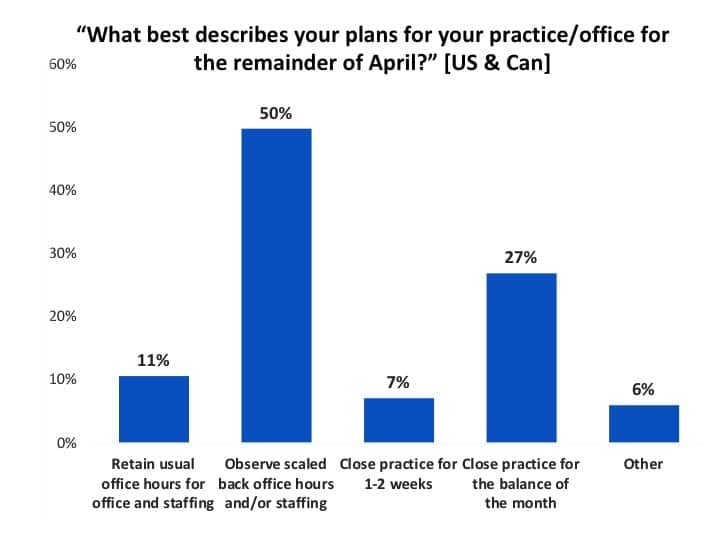

April-May plans for office hours and staffing. When US and Canadian offices were asked how dispensing offices would be staffed during the remainder of April (April 17-29), half (50%) said they would observe scaled-back hours and staffing, while 11% indicated they would retain their regular hours/staffing (Figure 6). Over one-quarter (27%) were planning to close the practice for the balance of the month, and 7% said the office would be closed for 1-2 weeks. Another 6% had various staff arrangements, only owners or receptionists working, etc.

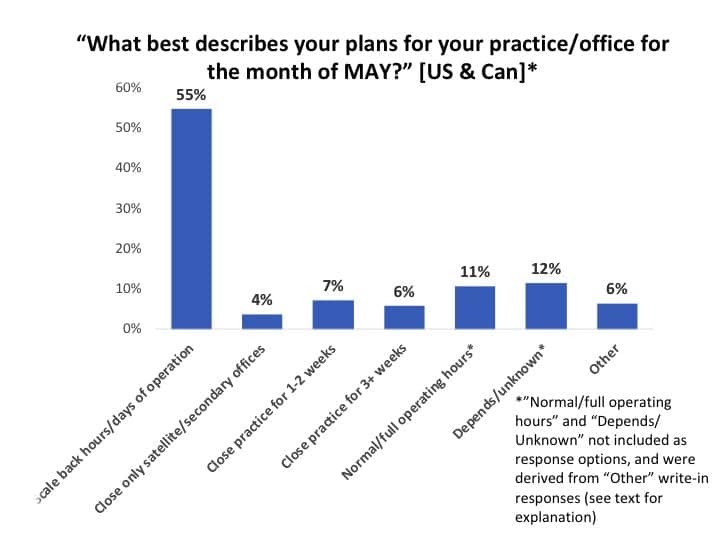

These same respondents were decidedly more optimistic for May (Figure 7). Only 13% anticipated closing for half of May (7%) or longer (6%) compared to about 27% in the last two weeks of April (see Figure 6). The majority (55%) of practices indicated they would observe scaled back hours/days of operation.

Unfortunately, this question did not include an answer for going back to “Normal/Full operating hours” (it was mistakenly deleted from the questionnaire). However, I separated the “Other” open-comment answers into three general categories: 11% indicated they were planning to have normal or full operating hours; 12% said that it depended on state/local government mandates and patient safety issues, their dispensing group/network, or similar factors; and the “Other” 6% indicated that they would “see if we will receive a PPP/EIDL loan” before making staffing decisions.

Although I debated keeping this question in this report, I think it hints that May will be a much better month—albeit with a gradual-paced recovery—than April.

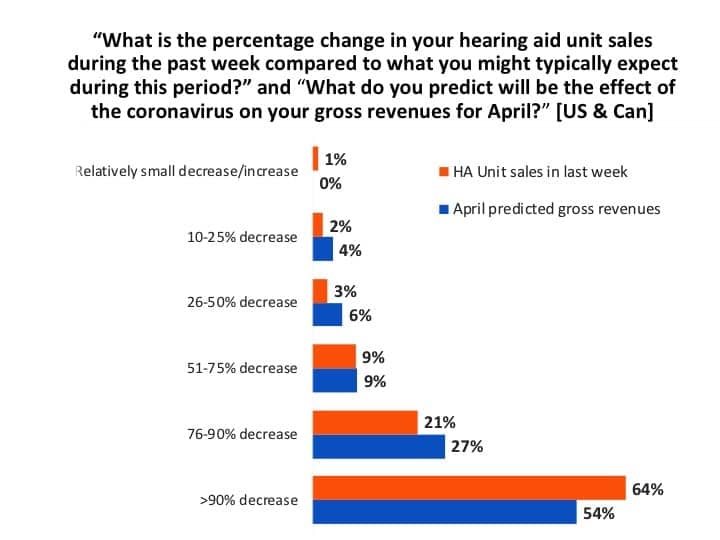

April hearing aid unit sales and gross revenues. Earlier in April, many market analysts were predicting a fall-off in hearing aid sales of 60-65%, but this survey suggests a decline probably more in the neighborhood of 80% for US and Canadian dispensing offices (Figure 8). In mid-April, about two-thirds (64%) of professionals reported that their hearing aid unit sales had fallen by over 90%, while another 21% said their sales had decreased by 76-90%.

When asked what they thought their gross revenues would be by month’s end in April, just over half (54%) predicted they’d see a 90%+ decrease, 27% said they’d experience a 76-90% decrease, while 19% said their gross revenues would decrease by 10-75%.

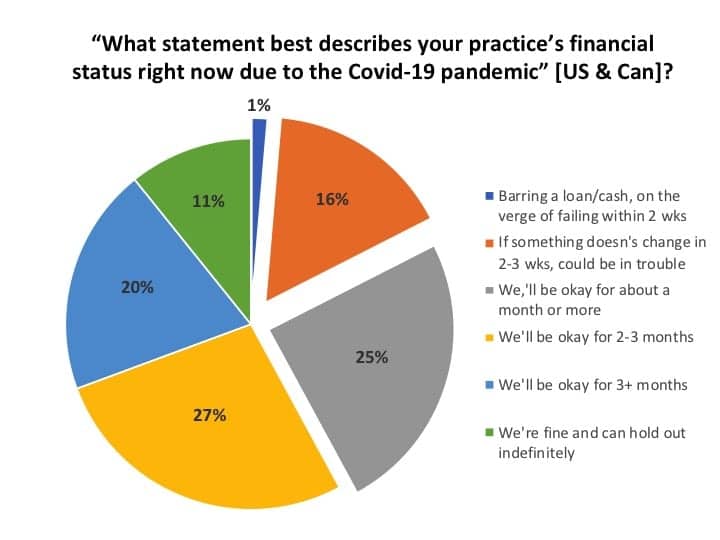

Financial status of the practice and cash-flow strategies. So, given this dismal information, what’s the financial stability of the practices surveyed? Figure 9 shows a slightly more optimistic outlook than our first survey, which in mid-March suggested about 1-in-5 practices would be in trouble if they had to close their doors for much longer than a week.1 In the present survey, only 1% of businesses appeared to be on the verge of failing within 2 weeks, while another 16% expressed concerns that “they could be in trouble” if something didn’t change (eg, PPP/EIDL loan) within the next 2-3 weeks. Another quarter (25%) indicated they would be okay financially “for about a month or more.” A similar percentage (27%) said they “would be okay for 2-3 months,” and one-in-five (20%) practices said they would “be okay for 3+ months.” A total of 11% of practices indicated they could “hold out indefinitely.”

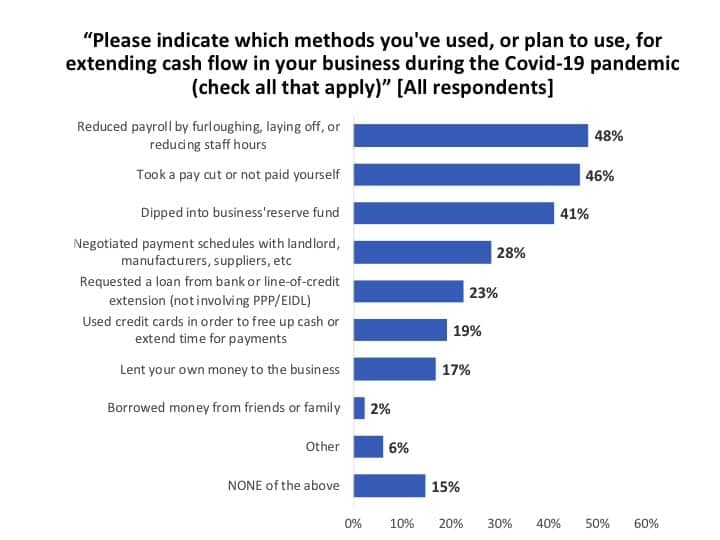

When asked what methods their businesses had used for extending cash-flow during the Covid-19 pandemic (Figure 10), about half (48%) of all survey respondents indicated they had reduced payroll by furloughing or laying off staff members or reducing their hours, and a similar number (46%) said they took a pay cut or did not pay themselves. About 2-in-5 practices (41%) dipped into a reserve fund set aside for the business, while about one-quarter (28%) either negotiated payments with a landlord, manufacturer, or supplier (28%), or requested a loan or line-of-credit extension from their bank (23%). Around one-fifth of practices either used credit cards to free up cash and extend payment times (19%) or lent their own money to the business (17%). Very few (2%) sought money from friends or family, and 6% cited other means, including grants, newly disbursed PPP/EIDL loans, and arrangements with groups and TPAs. Hearing Review recently published two articles about dealing with cash-flow problems featuring long-time practice management experts Dan Quall, MS, and Brian Taylor, AuD.5,6

Emerging from the Covid-19 Crisis as a Stronger Practice

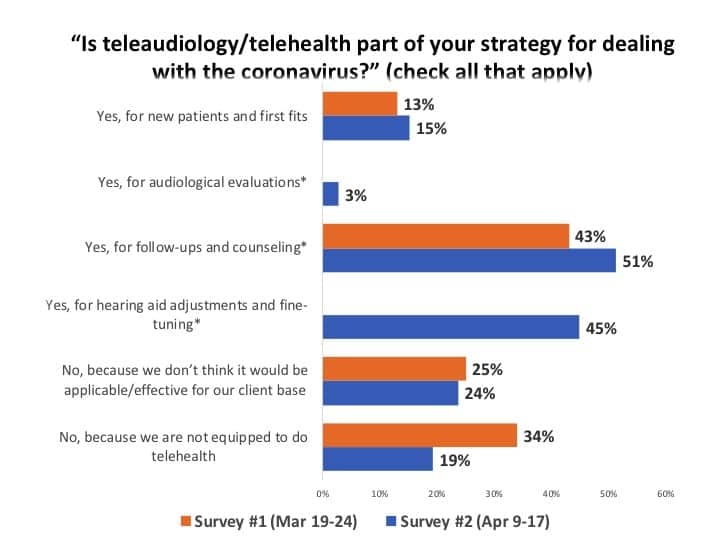

Employing teleaudiology. There has been speculation that the Covid-19 pandemic is spurring more HCPs into using teleaudiology (eAudiology or telehealth). Indeed, this appears to be the case. When comparing this survey’s results with roughly the same question in the Survey #1 about a month ago (Figure 11),1 one can see that utilization of teleaudiology has increased. Additionally, for all respondents, the percentage reporting their practice is not equipped to do teleaudiology decreased to 19% from 34%.

The majority of respondents (51%) said they were using teleaudiology for follow-ups and counseling, and 45% said they were using it for hearing aid adjustments and fine tuning. About equal percentages from the two surveys (15% vs 13%) used teleaudiology for new patients and first fits, while only 3% said they used it for audiological evaluations—a touchy area due to definitions and state licensure laws (eg, requirements for bone-conduction testing, etc).

The influence of temporarily loosened HIPAA rules in teleaudiology by the US Department of Health and Human Services (HHS) during the Covid-19 crisis certainly may also have influenced responses to this question, as pointed out in a recent LinkedIn post by Kim Cavitt, AuD, an expert in this area who has helped develop teleaudiology guidance documents for the Academy of Doctors of Audiology (ADA). Interestingly, about a quarter of HCPs in both surveys (24% and 25%) said they did not believe teleaudiology would be effective due to their client base, which for most HCPs means the senior population. (*Editor’s note: Survey #1 provided only a response for using teleaudiology for “follow-ups,” while Survey #2 asked slightly more refined questions that included hearing aid fine-tuning/adjustment and audiological evaluations.)

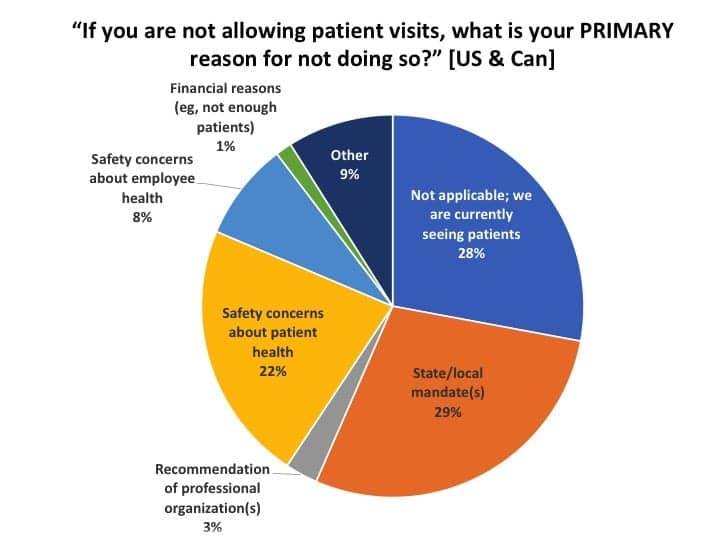

Barriers to physically seeing patients and strategies employed for office visits by patients. Figure 12 indicates that 28% of US and Canadian practices were seeing patients, roughly corresponding with the 21% reported for allowing patient visits in a previous related question (see Figure 2). When asked what was the primary reason for not seeing patients, about 3-in-6 respondents said it was due to local/state mandates such as “shelter-in-place” orders (29%) and due to safety concerns about patient or employee health (22% and 8%, respectively). About 9% ticked the “Other” box, with most citing a combination of the above or noting that they did see patients under special circumstances. Smaller percentages pointed to the recommendations of professional organizations (3%) or not having enough patients to justify it (1%). David Smriga recently published an article in Hearing Review discussing the decision-making process for “staying open,” and how states are using different language to define “essential services.”7

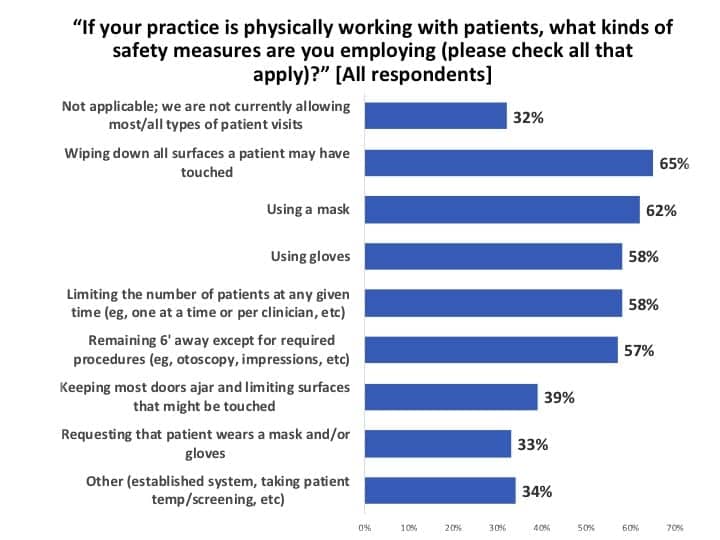

Those HCPs seeing patients said they were employing a variety of safety measures (Figure 13), the most prevalent being sanitizing and wiping down all surfaces that patients touch (65%), using masks and gloves while limiting the number of patients in the office at any given time (58-62%), keeping 6 feet away whenever possible (57%), reducing the number of surfaces a patient might touch (39%), and requesting that the patient wear a mask/gloves (33%).

It’s important to note that about one-third of HCPs (34%) checked the “Other” box on this question and then provided brief explanations or additions of the infection control systems or protocols they were employing. So, for example, although Figure 13 suggests only 57% are observing standard 6-foot “social distancing” guidelines, in reality many more respondents intimated fairly comprehensive systems that include social distancing to avoid contamination and spread of Covid-19.

Finally, the observant reader will note that Figure 12 indicates 28% of respondents said they are currently seeing patients, while Figure 13 indicates 32% are not seeing any patients. This would suggest a “gray area” of about 40% for practices accepting patient visits on a limited basis and/or only in special circumstances, as well as the various office hours and staffing arrangements being incorporated during this time (again, compare with Figure 2 for reference).

What are hearing care practices doing during their downtime to prepare for tomorrow? Just because there are few or no patients doesn’t mean there isn’t work being done. In fact, as Dan Quall noted in a recent Hearing Review interview: “Remember all the things you said you’d do for your business if you just had the time? Well, now’s that time!”5

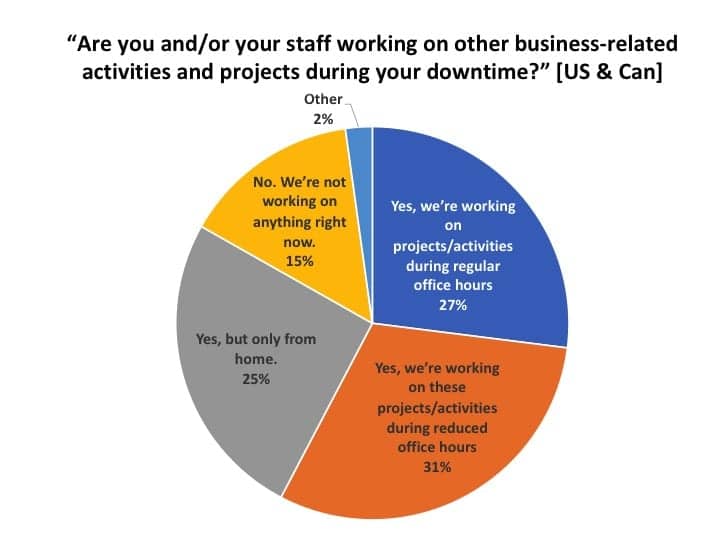

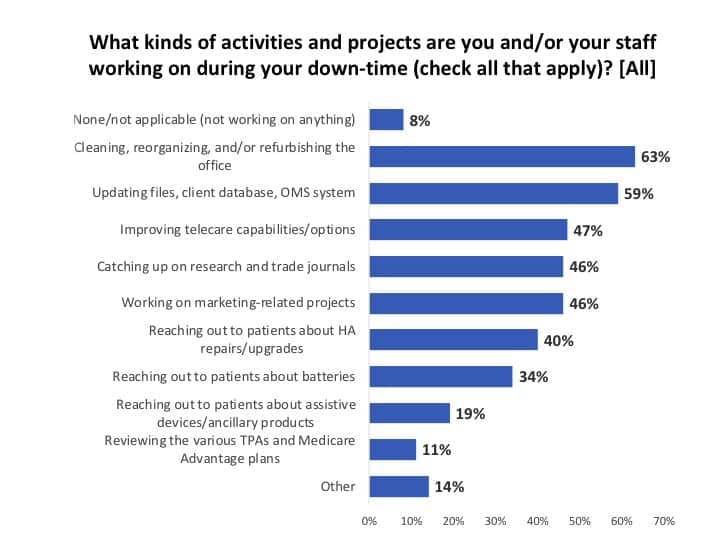

About 3-in-5 of all survey respondents said their offices were working on projects or activities during regular (27%) or reduced (31%) office hours, and another quarter (25%) said they were working on projects at home (Figure 14). In total, only 15% reported they were not working on anything (ie, essentially taking the downtime as a forced vacation)—although when presented with the list of activities and projects shown in Figure 15, only about half as many retained their answer of “not doing anything” (8%).

The most common projects were cleaning and refurbishing the office (63%) and updating files and the office management system (OMS) and/or the patient database. About half of the offices were working on improving their telecare capabilities (47%), catching up on research and trade journal articles (46%), and working on marketing-related projects. More than one-third of respondents said they and staff members were reaching out to patients about hearing aid upgrades and repairs (40%) and batteries (34%), while a smaller percentage were informing patients about assistive devices and ancillary products like remote mics, captioned telephones, and TV listening/loop systems (19%).

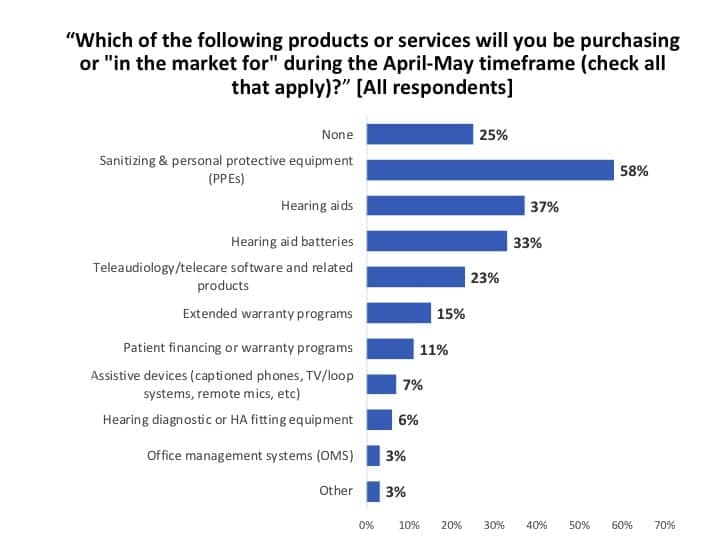

Products being eyed. Just because there is downtime, doesn’t mean HCPs are not researching products and looking for new solutions for the future. A total of 58% of all HCPs who took our survey indicated they were most interested in finding sources for sanitizing and personal protective equipment (PPEs) which have been in alarmingly short supply right now (Figure 16). About one-third each are purchasing or researching hearing aids (37%) and hearing aid batteries (33%), while about one-quarter (23%) are addressing their need for teleaudiology systems. Extended warranties (15%), patient financing options (11%), assistive devices (7%), diagnostic and special equipment (6%), and OMS software (3%) rounded out the list.

Key Findings

For the period from April 8-16, this survey found:

- While the largest majority (41%) of US and Canada offices are not accepting regular patient visits, 31% of offices are scheduling patients for appointments. Additionally, almost 3-in-4 practices are observing either regular (22%) or reduced (50%) office hours (Figure 1).

- The PPP and EIDL loans are “essential for survival” for about one-third (30-35%) of US dispensing offices (Figure 5), and are at least “important” for 77% of practices. Two-thirds (66%) of private practice and retail (PP&R) businesses have applied for the PPP loan, while another 11% have their applications in limbo at the bank and/or were still planning to apply for the loan.

- Although the outlook for hearing aid sales and gross revenues were anything but sunny in April (about an 80% decline from usual levels), HCPs anticipated a brighter scenario for May. Only half the percentage (13%) of US and Canadian respondents anticipated closing their offices for two weeks or longer in May, compared to the 27% closing their offices in the final 2-3 weeks of April (Figures 6-7).

- Slightly fewer than 3-in-5 practices (58%) say they’ll be financially solvent for 2 months or more if the current economic conditions persist (Figure 9). Another quarter (25%) say they’ll be okay for a month or more without aid, but just under 1-in-5 (17%) are in need of more immediate aid (eg, PPP/EIDL loan or some other cash infusion). The most common methods for making cash-flow stretch are furloughing/laying off employees (48%) and owners taking a pay cut or forgoing a salary/draw for themselves (46%).

- Teleaudiology has been thrust to the forefront as a hearing aid dispensing office tool. The percentage reporting their practice is not equipped to do teleaudiology has decreased to 19% from 34% only one month ago (Figure 11).

- About one-third of practices (29%) say their primary reason for office closure are state/local mandates (Figure 12)—and many/most of these in the United States are slated for revision during May.

- Practice staff members have undertaken a wide range of activities and projects to improve and prepare for the future. These include refurbishing and cleaning the practice space, updating patient files and the office management system, improving teleaudiology capabilities, and catching up on research and trade journals.

Acknowledgements

The Hearing Review thanks David Fabry, PhD, of Starkey Hearing Innovations for his suggestions on several questions. We also thank all the hearing care professionals who took the time to complete this survey and share your data so it might add important information to the decision-making process of your colleagues and the hearing healthcare industry.

References

- Strom KE. ‘Hearing Review’ coronavirus impact survey results (March 19-24). Hearing Review. 2020.

- Strom KE. Blog: Don’t delay in filing Paycheck Protection Program application. Hearing Review. April 5, 2020.

- Smriga D. Audnet website. PPP: So far, another example of the rich getting richer? April 19, 2020.

- Ransom D. PPP funding ran out in 14 days. Round 2 could go even faster. Inc. April 20, 2020.

- Strom KE. Cash-flow in hard times: Managing a practice through Covid-19 and other disasters. Survival tips and advice for emerging even stronger than before from Dan Quall, MS. Hearing Review. 2020;27(5):14-16.

- Taylor B. Plan for the worst, hope for the best: Strategies for cash-flow difficulties and Covid-19. Hearing Review. 2020;27(5):17.

- Smriga D. Staying open: Are you an essential service? Hearing Review. 2020;27(5):13.

About the author: Karl Strom is the editor in chief of The Hearing Review and has been reporting on hearing healthcare issues for over 25 years. He works from his home in Duluth, Minn.

CORRESPONDENCE can be addressed to: [email protected]

Citation for this article: Strom KE. Results of Covid-19 Impact Survey #2 (April 9-17) for Hearing Healthcare Practices. Hearing Review. 2020;27(5):10-12.

Really fantastic work and information here Karl. You truly did your homework and the details are very interesting. The profession will bounce back as our services are needed more than ever.

Thanks Michael! I agree: We will survive and emerge stronger and wiser for it!